working capital funding gap calculation

Premier Business Loan Marketplace. The company must elaborate on how to translate.

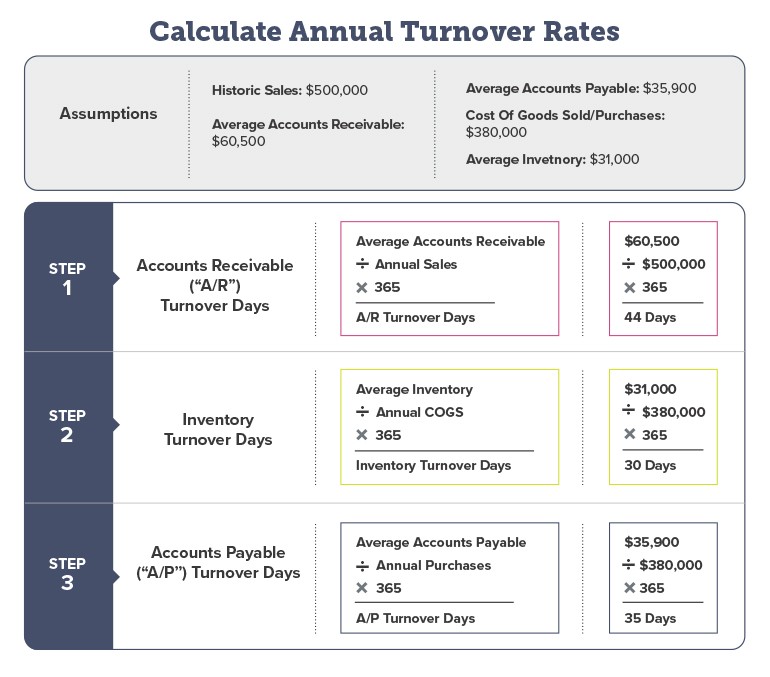

Days Working Capital Formula Calculate Example Investor S Analysis

Ad Get Working Capital Funding Fast.

. The calculation includes recievables days inventory days and. Working capital gap is the excess of current assets as per stipulations over normal current liabilities other than bank assistance. See why working capital management is no longer only a treasury function.

In the cash gap scenario discussed above working capital would be enhanced by providing your company with cash 80 of the invoice amount on day 9. Best Loan Options From More Lenders. Ad Working capital supply chain finance advice from leading industry experts.

Compare 2021s Top Online Working Capital Lenders. Working capital is what you have available to use in your business or in a very simple calculation you can say that working capital is the difference between all the current assets and all the. 1b Allow customers to delay payments.

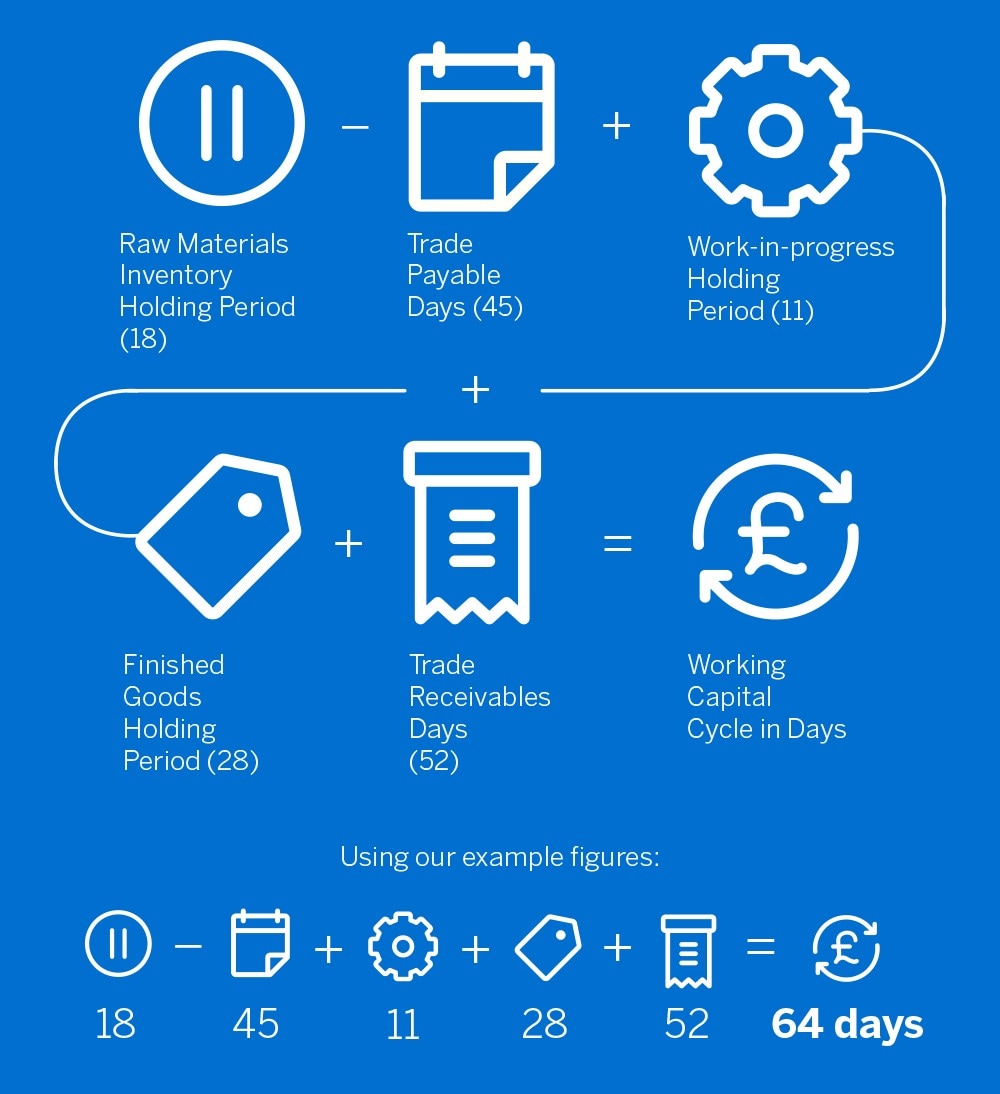

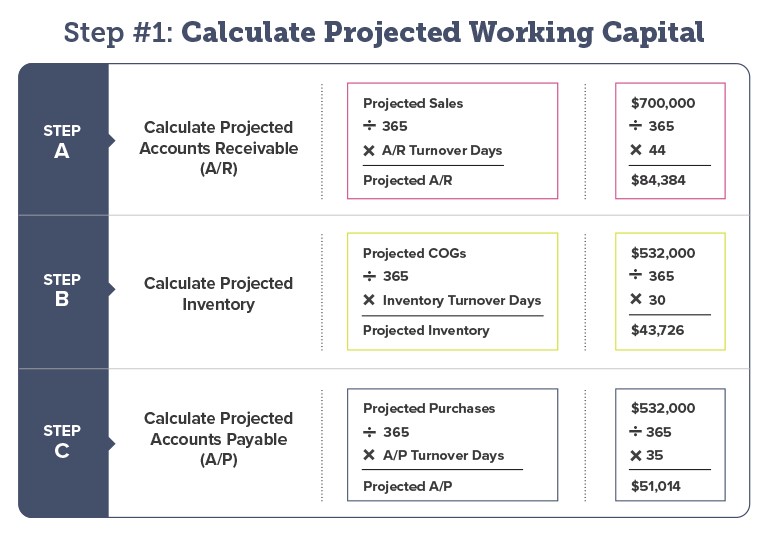

WACC used to calculate the funding gap. Working capital shortages can be created from a. The working capital cycle measures how efficiently a business is able to convert its working capital into revenue.

Apply Now Get Low Rates. Go to the LendingTree Official Site Get Offers. Delivering Better Decisions Accelerated Results - From Idea to Implementation.

Ad Loans Up To 500k. Link between the internal company documents in 3a and the data reported in the excel template. Working capital refers to the assets owned.

Ad EY Capital Allocation Services Help Businesses Assess Their Financial Fitness. The working capital calculator is an easy-to-use online tool that allows businesses to determine how much surplus cash they need to keep running. Apply Now Get Low Rates.

Ad Up to 500000 in 24 Hours For All Credit Levels Based On Cash Flow. Ad Compare Top 7 Working Capital Lenders of 2022. Loans Up To 500k.

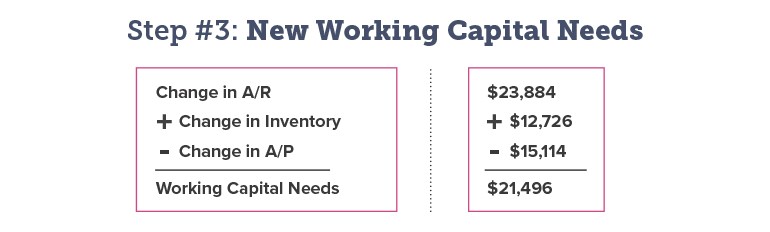

Ad Compare Top 7 Working Capital Lenders of 2022. 10000 Monthly Deposits Into Business Bank Account. Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

Working Capital Formula And Calculation Example Excel Template

Working Capital Cycle Definition How To Calculate

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Cycle What Is It With Calculation

Working Capital Cycle What Is It With Calculation

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Financial Edge Training

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Learn Accounting

Working Capital Requirement Wcr Agicap

Working Capital Formula Youtube

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Formula And Calculation Example Excel Template

Working Capital Cycle Understanding The Working Capital Cycle

Floating Interest Rate What It Is And When You Should Choose It Tarjeta De Credito Finanzas Tipos De Tarjetas

Dry Powder A Term Important To Investors Corporate And Private Equity Accounting Basics Learn Accounting Economics Lessons

How Much Working Capital Is Needed To Grow Your Business Pursuit

Bridge Loan Meaning Features How It Works Pros And Cons

How Much Working Capital Is Needed To Grow Your Business Pursuit

Dry Powder A Term Important To Investors Corporate And Private Equity Accounting Basics Learn Accounting Economics Lessons